French fashion label Chanel has edged out Louis Vuitton as the most reputable brand, according to a global analysis performed by Brandwatch Analytics.

Chanel scored 396 points out of a possible 500, edging out Louis Vuitton by a mere four points and Dior by 15. The brand’s extraordinary visibility and engagement on multiple platforms and the corresponding growth of its online following helped give it the narrow victory.

“A brand’s reputation will undoubtedly have an effect on revenue and growth,” said James Lovejoy, content and research manager at Brandwatch. “Yet drawing statistically significant relationships between online conversations and revenue is notoriously challenging because there are so many various elements at play.

“That said, our Brandwatch Social Index clearly places some of the highest grossing companies at the top: Chanel, Louis Vuitton and Dior,” he said. “Companies should consider what role they want to play online and how their social brand will affect sales, but hardline statements indicating a causal relationship between social media and overall revenue are not yet a reality.”

Looking at data from Q2 2016, “Luxury Fashion Social Index” scored 34 brands in the categories of social visibility, general visibility, net sentiment, reach growth and engagement/content, summing the scores to determine overall brand reputation.

Reputable source

In both general visibility and reach growth, Chanel scored a perfect 100, with Gucci following in general visibility at 93 and Burberry scoring an impressive 99 on reach growth. Chanel’s 91 in social visibility was good for third, behind Dior’s 97 and Louis Vuitton’s perfect score.

While social visibility measured a brand’s presence across social media channels, general visibility referred to conversation generated in news outlets, blogs and forums.

Chanel campaigns often appeal to consumers to engage or participate with the brand in more interactive ways.

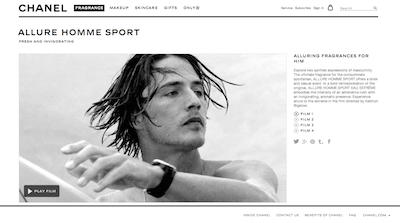

For example, in June the atelier encouraged adventurous and active males to dive, glide and slide in a push for its Allure Homme Sport fragrances.

The fragrance campaign encourages men to “own the experience” through the use of 360-degree videos housed on its Web site as well as its branded YouTube channel. With limited product offerings for male consumers, Chanel must capture the spirit of its intended consumers in a relatable way, playing to interests rather than its brand infamy (see story).

Interestingly, Chanel scored only 31 points in net sentiment, which measured the ratio of positive to negative statements made online about the brand. Gucci also scored a 31, and only Rolex, with 30 points, was lower.

One possibility is that these brands’ historic standing and name recognition makes them a lightning rod for irate customers to air their grievances.

Gucci did come under criticism from Britain’s Advertising Standards Authority in April for an ad that was determined to depict and unhealthily thin model (see story) and also drew up controversy in Hong Kong for a misunderstanding related to local funeral rituals (see story).

On the other hand controversy from the first quarter related to animal cruelty (see story) did not appear to impact Prada and Hermès, who were in the middle of the pack.

Similarly, Rolex, Chanel and other low scorers such as Breitling, Givenchy and Burberry were not embroidered in major controversies but scored low.

On the flip side, Cartier’s 100 blew away second place Versace, which scored 70. It is further worth noting that 25 of the 34 brands had scores of 40 or lower, and only five scored more than 50, suggesting that the transparency the Internet provides also can create negative discourse around a brand.

Additionally, a low score does not necessarily mean overwhelmingly negative response online.

“Tying sentiment or mood to a single metric or numerical value is notoriously difficult,” Mr. Lovejoy said. “To really understand what’s happening, businesses will need to parse and measure individual topics that drive negative and positive conversations.

“Ignoring neutral conversations, positive conversations surrounding Cartier outweighed negative ones 99.3 to 0.7 on Twitter,” he said. “Meanwhile, the Twitter conversation around Chanel was 93.2 percent positive and 6.8 percent negative. While this study looked at sentiment beyond Twitter, it’s clear that the difference isn’t actually that significant.”

“People who discuss these brands are generally positive, so when a handful of customers do have something negative to say the effect is greater. In a brief survey of Chanel, there are some complaints regarding customer service and price. While Chanel may be able to work on its customer service experience, its iconic name and exclusive price tag may always draw some level of criticism.”

Engagement and content was also a blowout, with Chanel’s second place score, a 74, trailing Ted Baker’s 100. Louis Vuitton and Dior followed with 68, and Rolex was fifth with a 65.

Rounding out the top 10 after Chanel, Louis Vuitton and Dior were Cartier, Tiffany & Co., Versace, Christian Louboutin, Prada and Michael Kors and Ted Baker. The lowest scorers – Lanvin, Dsquared2, Bottega Veneta, Kenzo and Salvatore Ferragamo – were sunk primarily by extremely low engagement scores.

Social engagement

While Brandwatch’s index helps to gauge overall market reputation, the popularity of a widely bought brand does not always sync with consumers’ perception of its value and luxury credentials, according to a survey by the Luxury Institute from earlier this year.

For its Luxury Brand Status Index series, Luxury Institute surveyed affluent women from seven of the world’s wealthiest nations to gain insights on which brands hold the most clout in terms of quality, exclusivity, social status and overall ownership. Consumer opinion is tied to whether one feels the asking price of a premium product is worth it, and it correlates directly to the brand’s perceived value among frequent and aspiring shoppers.

Despite the differences, Chanel, Louis Vuitton and Dior rank highly by either measure. Affluent women ranked Chanel and French leather goods maker Hermès as the two fashion houses most worth their premium asking prices, followed by Christian Dior, Louis Vuitton and Prada (see story).

By contrast, Hermès ranked 18th in Brandwatch’s index, owing to low social visibility and accompanying low engagement.

Online conversation around brands is driven almost entirely by consumers. Many brands, however, still keep a barrier between themselves and consumers, forgoing social media’s natural tendencies in favor of staying visible without compromising aspiration.

A Brandwatch report from last year shows that despite boasting immense followings, a large percentage of luxury fashion brands are surprisingly inactive on social media.

Brandwatch’s “Social Insights on the Luxury Fashion Industry” report has discovered that although a brand may place well by adopting social media, they are only scratching the surface of the opportunities available by mining social intelligence data. Luxury brands are often seen as latecomers in terms of embracing social and digital channels, but by fully taking into account the insights available from social media interactions, these labels can craft high-touch service in an online setting (see story).

“Amongst the top five, Louis Vuitton overtook Dior for the number two spot largely by raising its visibility scores,” Mr. Lovejoy said. “Cartier jumped from 8th to 4th due to its improved net sentiment and reach growth scores. Tiffany & Co. jumped from 7th to 5th with an increase in reach growth and a slight development in its social visibility.

“Prada had one of the strongest improvements, moving from 18th to 8th, in large part due to strong reach growth and modest growth in social visibility and engagement and content,” he said. “This is a competitive industry; reputation is a vital part of business for luxury fashion retailers.

“It may be difficult to take some of the leaders off their top positions, but at the same brands like Prada, which jumped up 10 spots, indicate that there is still room for movement and growth,” he said.

from Jewelry – Luxury Daily https://www.luxurydaily.com/chanel-most-reputable-brand-despite-low-sentiment-report/

via Your #1 Source to Finding Luxury & Designer Goods, Handbags & Clothes at or Below Wholesale: Click Here.

No comments:

Post a Comment