Chinese home-sharing service Tujia is expanding its sphere of influence beyond its home country.

The “Airbnb of China” has acquired competitor mayi.com to consolidate its position as a market leader and is now branching out to outbound Chinese’s top vacation destinations. The home-sharing market has already pilfered revenue from luxury hotels in the west, and Tujia’s growth represents another threat to the market share of high-end hotels.

“Luxury Hotels are still able to offer the personalized level of service that is absolutely vital to a majority of the affluent travelers, and therefore have the loyal guests who will always prefer the luxurious amenities and personalized services that come with the hotel,” said Damon Banks, editor-in-chief of LuxeGetaways Magazine.

Mr. Banks is not associated with Tujia, but agreed to comment as an industry expert.

Tujia could not be reached for comment.

Beyond the border

Tujia’s divergence from Airbnb is largely associated with cultural differences. Tujia manages a share of the homes on its marketplace, and those that are owned or managed by third parties are inspected before the booking party arrives.

These inspectors verify that photos are accurate and ensure the home is clean and hospitable. Tujia also provides house cleaning, and some properties even have butlers, bicycles or car rentals available, all dependent on the location and the properties. On the whole, its focus is skewed toward the high-end.

Around two months after being acquired, mayi.com has seen average daily orders quintuple. Including mayi.com orders, Tujia announced that August saw 56,000 room nights booked, a record for the business.

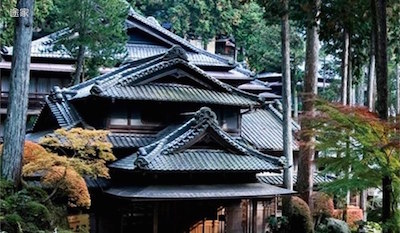

In total, Tujia services 430,000 properties and has recorded 300 percent growth per year. The brand is now setting its sights on Southeast Asia, Japan and South Korea for expansion.

Those territories are the top destinations for outbound Chinese tourists. As Tujia penetrates those markets, luxury hotels stand to lose market share as consumers opt for a local, familiar brand name as well as the advantages that come with staying in a home rather than a hotel.

Among the brands looking to the same region for growth are St. Regis (see story) and Four Seasons (see story).

At present, Tujia focuses almost entirely on outbound Chinese consumers but has a limited presence in western markets. Nevertheless, the company’s rapid growth suggests that properties in the United States, United Kingdom and Europe could be possibilities, as could an appeal to China’s booming incoming tourist population.

Faced with a new competitor, luxury brands need to act fast to cultivate a loyal base of affluent Chinese consumers and provide value that Tujia cannot in the form of concierge, cuisine and other such services.

Increased competition

The hotel industry was not prepared for the disruption that Airbnb has caused. The same mistake could be even more costly given China’s enormous population and growing per capita GDP.

Last year Airbnb disrupted the hospitality industry to the tune of $1 billion, according to an iModerate report.

The report found that Airbnb clients skew young and budget-conscious, with a taste for adventure and a craving for local culture, compared to hotel clients who see the hotel itself as a destination. Boutique labels are an effective way to acquire Airbnb users, but consumers often choose based on what they want from the trip.

While hotels appeal to consumers because they offer familiarity and certainty, Airbnb has attracted frequent visitors for the opposite reason. The thrill of not knowing for sure what one will get and the accompanying possibility of unique experiences interests younger travelers.

Women, iModerate found, especially appreciate being in an environment resembling a home rather than a hotel. The chance to be near and live like locals in neighborhoods removed from commercial hotel properties is another draw for Airbnb lodgers, and is something hotels will have difficulty countering (see story).

However, given Tujia’s focus on the high-end and greater focus on service, Airbnb’s precedent will not be matched exactly.

Other home-sharing services specific to a particular country and focused on affluent clients have also seen success.

For example, Merino Hospitality is offering London-bound travelers and transplants the best of both worlds.

The company diverges from hotels in offering kitchens, other amenities and larger amounts of space sufficient for larger groups but, unlike Airbnb, does not sacrifice the advantages of a hotel’s service and concierge. Changes in both consumers’ travel patterns and mindsets are reshuffling the hospitality industry (see story).

“As the industry has proven time and time again, there is a place for everything in the hospitality world,” Mr. Banks said. “I don’t think that the luxury hotels should be too worried about the number of travelers choosing to use Tujia.”

from Travel and hospitality – Luxury Daily https://www.luxurydaily.com/airbnb-of-china-challenges-hotels-with-international-expansion/

via Your #1 Source to Finding Luxury & Designer Goods, Handbags & Clothes at or Below Wholesale: Click Here.

No comments:

Post a Comment