Luxury brands can no longer forego a presence in China and hope to make up the difference with tourists, according to a new report by L2.

Double-digit growth days are over in China, and even if it will continue to grow at rates that will make western countries envious, its domestic luxury market contracted in both 2014 and 2015. With China growing, brands will need to adjust to digital issues ranging from poor localization to varied pricing as they compete for a clearly finite market.

“Brands have primarily held back from ecommerce in China for fear of diluting their brand and image,” said Danielle Bailey, study lead at L2. “They believe their brand will be swimming in a sea of counterfeits and grey market re-sellers; however, consumers, especially luxury shoppers are looking for authenticity and online platforms that can provide it.

“There is also a perception that high-end consumers do not shop online and that they are unwilling to make purchases online above a certain price point,” she said. “For luxury shoppers, as with all Chinese consumers, shopping online is the way they shop.There is some indication that price transparency may actually spur purchase decisions.

“Especially in China, brands emphasized the high touch, in-store luxury shopping experience as an extension of the brand. As opening stores in China is no longer viable, e-commerce allows brands to access wealthy customers throughout the country who don’t have access to retail locations.”

“Luxury China 2016” looks at the performance of over 100 brands in China’s ecommerce market, including mobile performance and social media presence.

Catching up

Digital is still only a small part of China’s luxury market, comprising just 5 percent in 2015. Still, its growth rate was triple the overall market, and as brands make it easier for consumers to purchase products at fair prices, growth will only accelerate.

Mobile is chief among necessary investments. Mobile traffic in China has increased 50 percent from the year-ago and is almost twice as high as desktop traffic. Nevertheless, less than half of fashion brands and less than a quarter of watch and jewelry brands support mobile purchasing.

Evaluating the digital performance of brands in China, only Burberry and Cartier, with scores of 152 and 141, are in the Genius category. However, a number of fashion houses, including Gucci, Valentino, Louis Vuitton, Dior and Michael Kors, as well as watchmakers/jewelers Omega, Piaget, Swarovski and Tag Heuer, are in the Gifted category.

But despite some top performers, an alarming number of big-name brands rank in the feeble category. These include Ralph Lauren, Marc Jacobs, Baume & Mercier, Moncler, Diane von Furstenburg, Piguet, Tod’s, De Beers, Hublot, Berluti, Christian Louboutin, Harry Winston, Oscar de la Renta and Baccarat.

Overall, the Feeble and Challenged categories are the largest. The massive gap between the best and worst performers testifies to how far behind many players are in China’s marketplace.

While Burberry’s launch on Tmall in April 2014 was expected to pave the way for other luxury brands to follow, few have done so. Fifty-six percent of what L2 defines as “pure luxury” players still rely on Yoox and Net-A-Porter for ecommerce in China.

“Accessible luxury” brands have been more proactive on China’s ecommerce platforms. Hugo Boss has its lower-end Boss Orange line on Tmall but its full collection on its direct-to-consumer site.

Zegna and Michael Kors, although not on Tmall, are featured on the retailer’s flash sale channels done in conjunction with Mei.com. Generally, however, brands have not fully established ecommerce capabilities in China, hoping instead to reach consumers during overseas shopping trips.

Burberry Lunar New Year WeChat promotion

Paradoxically, brands have adapted to social media, with the majority of both fashion and watch and jewelry brands having a presence on Weibo, WeChat and video-sharing platform Youku Toudu. While this presence helps build visibility and desirability, insufficient ecommerce infrastructure is preventing brands from capitalizing.

Moreover, brands are not linking to WeChat and other social platforms across channels. Only around half of brands link to WeChat from brand sites, and Armani is the only of 12 fashion brands with Tmall stores to link to its WeChat.

The struggle to provide an optimal mobile experience is also visible, particularly among watches and jewelry brands. Only 24 percent of watch and jewelry brands have mcommerce-enabled mobile sites, compared to 43 percent of fashion brands. Mobile optimization is equally grim, at 24 percent and 33 percent, respectively.

Making progress

While ecommerce in China generally lags among luxury brands, recent improvements and campaigns prove that brands are aware they need to reach Chinese consumers in their homes.

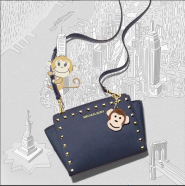

Coinciding with Lunar New Year earlier this year, U.S. fashion label Michael Kors launched its first campaign on popular Chinese social photography application “in.”

On the app, the brand created a series of stickers depicting a cartoon monkey on a world tour as well as popular handbag styles, which “in” users can add to their photos before sharing with family and friends. According to Michael Kors, this is the first time a luxury fashion brand has partnered with “in,” giving the label visibility on a widely used platform during the important shopping holiday (see story).

Although Chinese ecommerce is a clear growth area, it is an opportunity that is easier to identify than implement.

Global heterogeneity presents many obstacles for brands looking to maximize their share through localization efforts, according to an L2 report from last September.

The share of ecommerce sales in the luxury industry has tripled since 2009 and is set to triple again by 2025, but obstacles such as currency, language, selection and payment method may make it difficult for brands to expand and capitalize on their reach. As social media, the Web, and the development of BRIC, Asian and Sub-Saharan Africa in the future give brands more visibility, it is essential that they monetize global consumers (see story).

“Nothing about marketing in or to China is easy,” Ms. Bailey said. “If brands are looking to take a first step, I would prioritize a WeChat presence – it will provide a means of connecting directly with consumers and for the brand to share their heritage, multimedia branded content, retail locations, and provide authenticity checks.

“Brands easily add on more sophisticated functionality, including commerce, as the brand comes online – specifically if the brand is not yet willing to invest in a brand site,” she said. “However, brands still have to promote their WeChat presence in order to gain traction. The Chinese digital ecosystem is so much more interconnected than in the West that it is often not enough to just pull a single lever.

from Apparel and accessories – Luxury Daily https://www.luxurydaily.com/burberry-and-cartier-set-standard-in-lagging-chinese-ecommerce-adaptation/

via Your #1 Source to Finding Luxury & Designer Goods, Handbags & Clothes at or Below Wholesale: Click Here.

No comments:

Post a Comment