Free trade developments have allowed businesses to operate in multiple countries with unprecedented ease, but businesspeople are still met with obstacles.

While the restrictions in operating across disparate countries have eased, the visa requirements for the operators to enter each country have not. For international businesspeople and frequent travelers of all sorts, passports have emerged as a luxury item enabling individual freedoms that have not caught up with business freedoms.

“It’s a huge psychological thing, but millionaires, you’ve got people worth 10, 20, 30, 40, 50 million who build up really nice businesses and work their butts off to be successful and yet are very limited in their freedom of movement around the world,” said Nuri Katz, founder of Apex Capital Partners, an international firm that works with multinational affluent investors to buy passports. “So when somebody starts making real dough he wants to be able to travel and use his money without having to ask, just like a Canadian or a Brit or an American or anybody else.

“The poorest American has the right to go to France for dinner and the richest Russian or Chinese or Middle Easterner does not,” he said. “That’s one thing, a really important feeling of freedom.

“The number of millionaires and billionaires being created around the world is growing vastly, especially in developing countries such as China and Russia and in the Middle East, in India as well, and you also have it in Pakistan. These are people who want freedom like you have and like I have. So to pay for citizenship is not not such a big deal.”

Travel without borders

While the affluent may operate businesses in multiple countries without any trouble, the mere act of moving from country to country can be difficult. The restrictions on traveling and visa processes can hinder traveling abilities.

For example, a U.S. businessperson who needs to visit Japan and Russia in short succession could find herself in a pinch. While the passport and documentation to acquire a visa is mailed off to an embassy, she cannot go to Japan.

Apex Capital Partners is one firm that works with multinational businesspeople and other frequent travelers to help resolve such problems. Investing in a passport for another country that does not need a visa for any upcoming destination eases the stress of travel.

St. Kitts & Nevis; image courtesy Apex

Apex began in the early 1990s when Canada was the only nation to offer legal migration through investment. As Canada’s program saw signs of success, other nations began to follow suit.

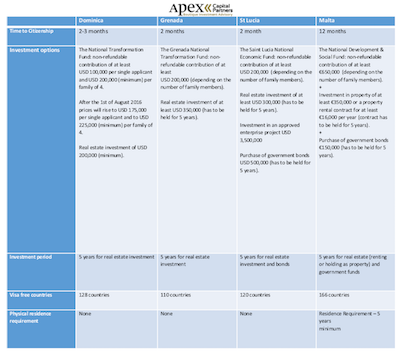

Aware of these particularly 21st-century business obstacles, numerous countries have created passport investment programs. Over the past five years alone, the number of countries with Citizenship by Investment programs has skyrocketed and is now upwards of 50, with many smaller nations having more generous programs to help fuel the local economy.

Generally, private citizens make an investment – often times in real estate – in an amount ranging from $50,000 to nearly $3 million depending on the country. In return, the citizen will meet the legal requirements for attaining a passport from that nation, subject to the same rules.

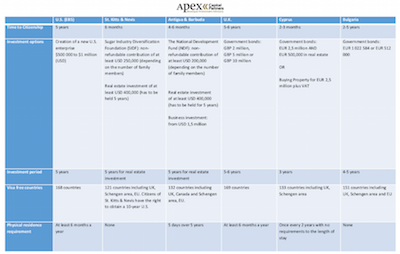

Among the most popular countries for citizenship investment is St. Kitts & Nevis, which provides citizenship in six months provided at least $450,000 of real estate is held for at least five years or at least $250,000 is contributed to the Sugar Industry Diversification Foundation. The country’s passport offers visa-free travel to the U.K. and European Union and rights to a 10-year U.S. visa, and has no physical residence requirements.

Other Caribbean nations are also popular with comparable terms. In the EU, Cyprus is among the most popular options. While the price tag is hefty – approximately $3 million – a residency requirement of being present once every two years with no length of stay requirement, as well as the right to live in the EU that it provides, makes it a popular option.

Apex works as a facilitator, meeting with clients to determine their needs, and then selecting which citizenship investment programs are the best fit.

Aside from the ease they allow multinational businesspeople, citizenship also serves as a tax haven for the affluent. Mr. Katz notes that the revelations of the Panama Papers – recently leaked documents containing information about hundred of thousands of offshore entities – have eroded trust in bank secrecy and the validity of hiding and moving money.

Accordingly, residence in low-tax jurisdictions is emerging as a viable alternative.

While the U.S. taxes based on citizenship, most nations tax based on place of residence. St. Kitts does not charge income tax, so high-net-worth individuals looking to escape to the Caribbean for some time can also avoid paying taxes.

Wealth boom

Mr. Katz further highlighted that there has been an influx of Chinese affluent investing specifically in U.S. passports. The expedited creation of wealth in China and neighboring nations, combined with the vast number of visa-free capabilities of a U.S. passport, make them a natural pair.

Asia, led by China and the Association of Southeast Asian Nations, saw the most growth out of any region, with its billionaire population up 15.2 percent and their wealth increasing 19.6 percent. This is far greater than the global average of 6.4 percent more billionaires and a 5.4 percent increase in wealth.

Following Asia was the Middle East, with 9 percent greater wealth and 7.8 percent more billionaires.

With slightly more modest growth, the Americas now have $3 trillion in collective assets among billionaires, taking away the EMEA’s lead as Europe’s wealth declined 1.9 percent and Africa’s fell 14 percent (see story).

As the number of UHNW individuals grow and their geographical profile diversifies, the demand for citizenship investment will grow alongside it.

Lastly, passports also serve as a status symbol, similar to a black American Express credit card or a nice car.

“People enjoy the idea of being able to talk about and show that they got this passport because it shows you’ve got the dough to buy this,” Mr. Katz said. “People show it; very often you’ll see a number of my clients will specifically carry it with them around just to be able to show it.

“It’s cool; it shows you have the ability to, enough disposable income to spend a few hundred thousand dollars on a passport,” he said. “For a lot of people that makes them feel good. Some people spend on cars, some people spend on houses, and some people spend it on passports, and that industry is growing.”

from Travel and hospitality – Luxury Daily https://www.luxurydaily.com/globalization-wealth-creation-spur-demand-for-passport-investment-programs/

via Your #1 Source to Finding Luxury & Designer Goods, Handbags & Clothes at or Below Wholesale: Click Here.

No comments:

Post a Comment